News from 2020-12-07 / KfW Development Bank

Support for Morocco in the COVID-19 pandemic

Support for Morocco in the COVID 19 pandemic

KfW Development Bank has pledged more than EUR 1 billion for social security, stabilisation of enterprises and employment, and financial sector reform.

The Kingdom of Morocco is severely affected by the COVID 19 pandemic. After the first cases of the disease in March 2020, the country's government reacted quickly, severely restricting public life and closing the borders. Far-reaching social and economic consequences of these restrictions were unavoidable. The slump in economic activity has also affected profitable sectors, especially the aviation industry, the textile and leather sector, the metalworking industry and the automotive suppliers, which are also export-oriented. Morocco's real gross domestic product is expected to fall by at least six % this year. Thus, for the first time in two decades, the country is experiencing a recession, which is expected to leave its mark on society and the economy in the coming year.

Like many other emerging economies, Morocco is particularly vulnerable in this acute crisis. Social security systems such as health or unemployment insurance are not yet particularly efficient or robust. Above all, employees in the informal sector, who have hardly any reserves anyway, are now quickly finding themselves in existential difficulties. Around 4.3 out of 8.8 million households in Morocco depend on income from the informal sector. These population groups are in urgent need of support. This is particularly true for the population in structurally weak rural areas, especially women. According to a study by the Ministry of Tourism, Moroccan handicraft enterprises lost around 95 % of their income during the hard lockdown.

COVID-19 emergency aid programme of the German Federal Government

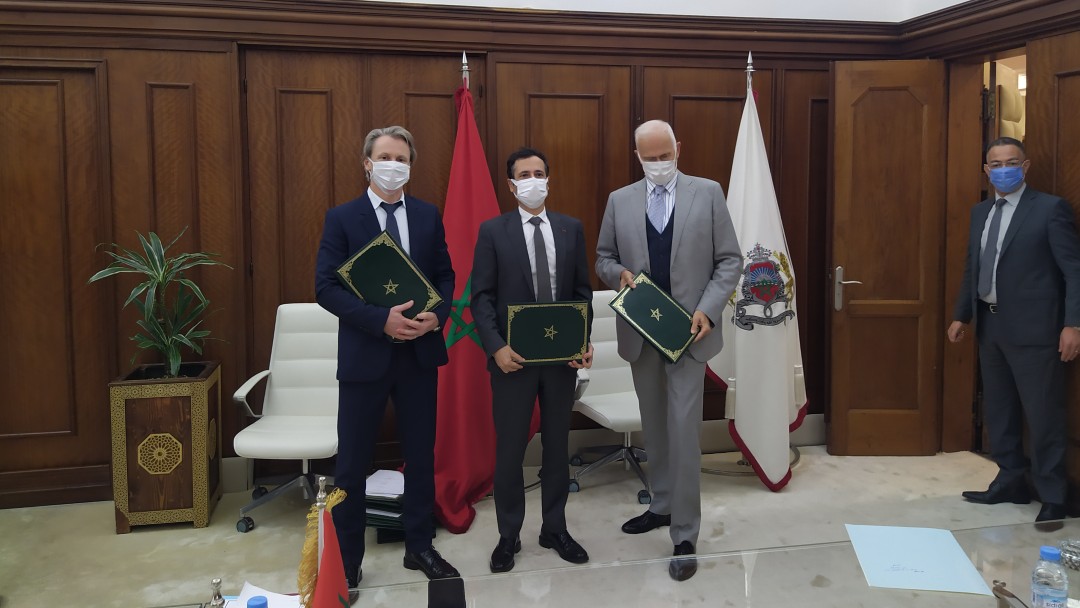

The Moroccan Government set up specific support and stabilisation programmes with its development partners from the international community soon after the first signs of the pandemic appeared. Some EUR 3 billion have been made available to immediately combat the COVID-19 pandemic and to mitigate the economic and social consequences of the crisis. On behalf of the Federal Ministry for Economic Cooperation and Development (BMZ), KfW is also supporting the country in overcoming the crisis as part of a "Corona Emergency Aid Programme". To this end, financing agreements for around EUR 1 billion were concluded on 27 November 2020 in Rabat between the Moroccan Ministry of Economy, Finance and Administrative Reform (MEFRA) and KfW Development Bank. Most of the funds are to be disbursed to Morocco this year. They will be used, among other things, for the central promotional approaches described below as corona emergency aid for the social security systems, in credit guarantee mechanisms and in the reform of the national financial system.

Support for social security systems

The "Emergency aid to cope with the corona epidemic and its consequences" will provide the Moroccan Government with up to EUR 300 million in loans for targeted support measures to support social security systems and the economy. For example, transfer payments to particularly vulnerable groups of the population and "short-time work benefits" will be financed, but medical testing capacities will also be expanded. The aid programmes are aimed at the formal and informal sectors.

Loan guarantees for small and young enterprises

In Morocco, micro, small and medium-sized enterprises (MSMEs) and start-ups often find it difficult to obtain loans to develop their business activities. Banks and even microfinance institutions shy away from the risks of payment defaults. The COVID 19 pandemic has further exacerbated this problem. Yet it is precisely the smaller private enterprises, which employ more than half of the workforce, that need cheap loans, especially now in the crisis, in order to avoid layoffs and insolvencies as far as possible. The Moroccan government estimates the financing requirements to cover the loan guarantees required as a result of the crisis at around EUR 1 billion until the end of 2023. On behalf of BMZ, KfW is therefore providing the country with up to EUR 400 million in loans as part of the German COVID-19 emergency aid. In addition, the Moroccan state promotional institution “Caisse Centrale de Garantie” is being supported with expertise to ensure that financial products tailored to customer needs and with rapid processing are launched on the market to stabilise smaller private enterprises.

Reform partnership: Financial system development and promotion of the private sector

Another important component of German support for Morocco in the COVID 19 pandemic is development measures aimed at reforming the national financial system and thus also promoting the private sector. Therefore BMZ and Morocco have already agreed a special "reform partnership" in 2019. This will provide Morocco with special support for sustainable economic development, which BMZ is providing as part of its "Marshall Plan with Africa" to concretise Germany's involvement in the G-20 initiative “Compact with Africa”. The recent signing of a loan agreement with KfW Development Bank for EUR 250 million marks the start of this outstanding partnership in practice. It comes at exactly the right time in the COVID 19 crisis. Further reform financing of this kind is to follow in the next few years if Morocco continues to pursue the reform path it has embarked on in the financial sector consistently and successfully. For example, financial inclusion is to be effectively anchored structurally, the microfinance sector strengthened, the country's mobile banking system expanded and the deposit insurance system of Moroccan banks modernised.

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: https://www.kfw-entwicklungsbank.de/s/enzBWrMC.CXZA

Copy link Link copied